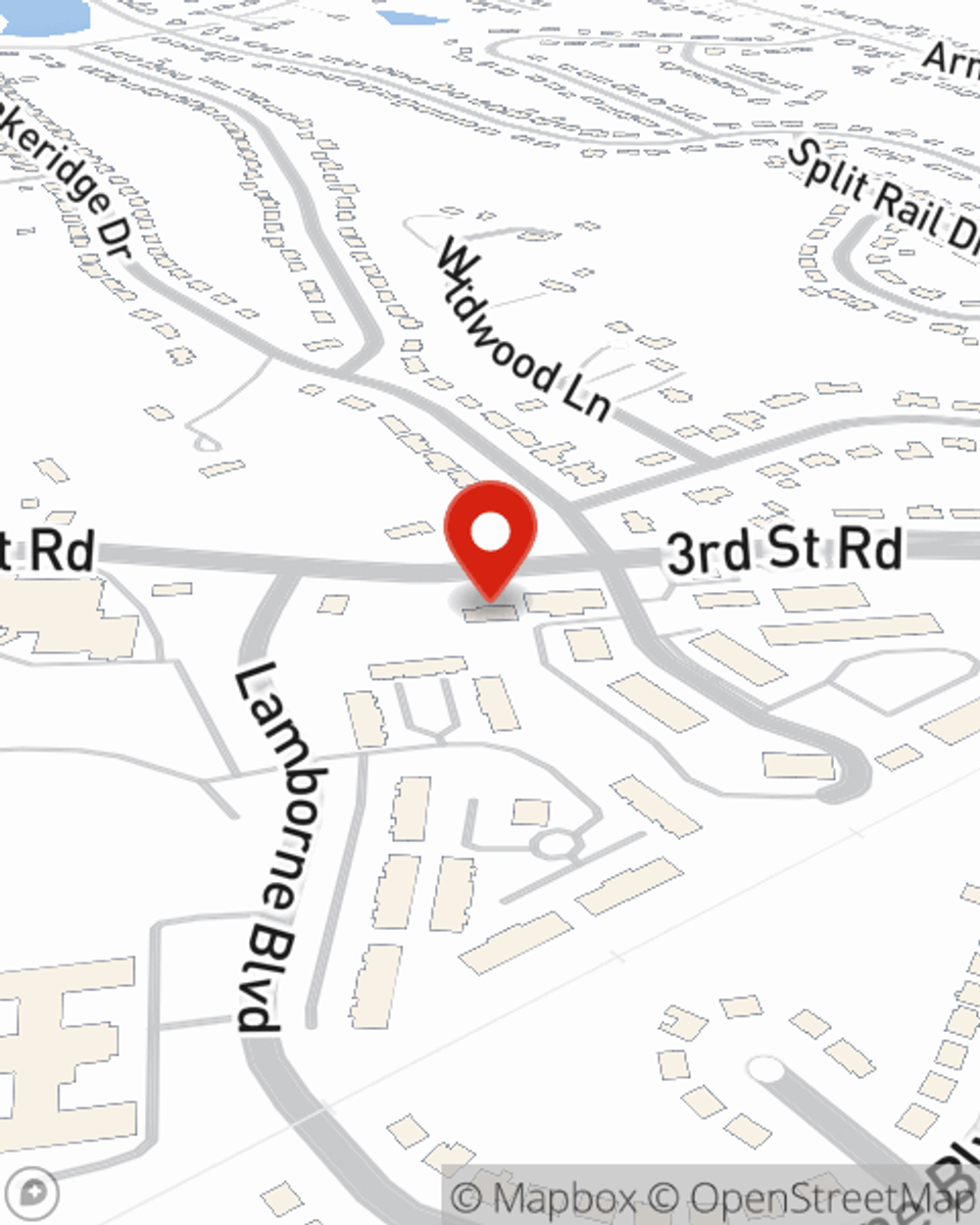

Life Insurance in and around Louisville

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Kentucky

- Louisville

- Elizabethtown

- Brandenburg

- Fairdale

- Valley Station

- Indiana

- Jeffersonville

- New Albany

- Clarksville

Protect Those You Love Most

One of the greatest ways you can protect the ones you hold dear is by taking the steps to be prepared. As pained as considering this may make you feel, it's good to make sure you have life insurance to prepare for the unexpected.

Coverage for your loved ones' sake

Life won't wait. Neither should you.

State Farm Can Help You Rest Easy

Having the right life insurance coverage can help loss be a bit less complicated for your family and allow time to grieve. It can also help cover current and future needs like childcare costs, ongoing expenses and utility bills.

If you're looking for dependable coverage and compassionate service, you're in the right place. Call or email State Farm agent Naomi Stevens today to get started on which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Naomi at (502) 937-8833 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Naomi Stevens

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.